Fintech Highlights - 8/30/2022

👋 Thanks again for subscribing.

Pinned to the Top

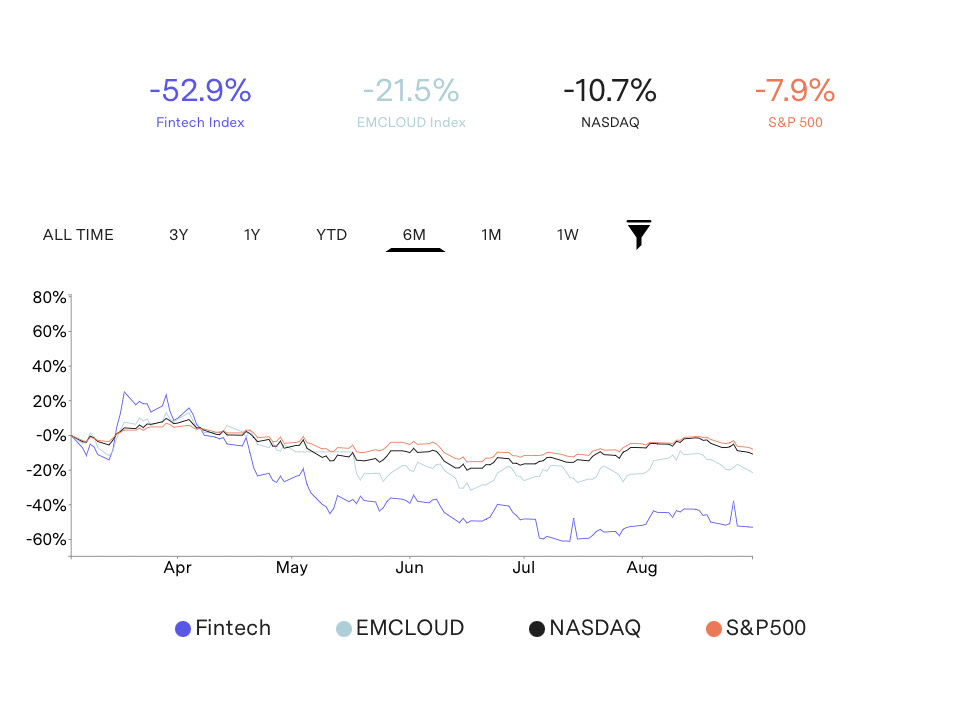

F-Prime, a prominent fintech focused venture capital firm - has designed an index to track the performance of emerging, publicly traded financial technology companies. And lately - something interesting is happening with fintech stocks (here ->)

The Index has picked up a 41% increase, compared to EMCloud’s 19.5%, Nasdaq’s 15.6%, and S&P’s 12.2% increases.

Notably, it said, Affirm is leading the pack and is up 67%. Insurance stocks are up 46% overall, led by Lemonade and Oscar Health. Payment stocks are up 44% driven by Wise and Mercado Libre. Wealth and asset management stocks are also up 32%, driven by Coinbase and Bakkt Holdings.

Meanwhile, banking and lending stocks are up 24%.

Have a look here ->

The BFD

US fintech LendUp has started liquidating its assets, including neobank subsidiary Ahead Money. The news doesn’t come as a huge surprise off the back of a December ruling from the Consumer Financial Protection Bureau - that the company had to cease lending after allegedly misleading customers.

Why this is the BFD: LendUp styled itself as an alternative to payday loans, offering single-payment or instalment loans as part of the ‘LendUp Ladder’ - a system that allowed customers to access bigger loans at smaller rates over time.But the CFPB found that 140,000 repeat borrowers were charged the same or an even higher interest rate for loans despite working their way up this ladder. It doesn’t get much more cynical than that.

The big picture: This case raises the age-old question of whether or not businesses following this model can ever be truly ethical. Our two cents? Don’t count on it.

M&A

Toronto insuretech startup Relay Platform has been acquired by At-Bay, a digital insurance provider based in San Francisco. According to At-Bay, Relay will continue to operate as an independent entity, under its own management team. More here ->

Truist has made a couple of recent acquisitions to bolster it’s banking offering. The first is the data goverance platform Zaloni. The other being in May - fintech startup Long Game - in effort to reach younger demographic. More here ->

Fintech

Deposits, a Dallas-based provider of digital banking tools for credit unions, raised $5m in funding. Deposits offers a cloud-based, plug-and-play feature to simplify the implementation of digital banking tools for companies like credit unions, community banks, insurers, retailers and brands. More here ->

Kasisto, a New York-based digital assistant for the financial services industry, raised a $15.5m Series C extension co-led by Fidelity and Westpac. More here ->

Highline Technologies, a payroll-linked lending startup, raised $13m in Series A funding. Highline is a "new payments platform that automates bill payments directly from payroll. Lenders can decrease missed payments by up to 2/3rds, reduce credit losses, expand customers’ credit options, and better support financial wellness.” More here ->

Nitra, a New York-based cashback card for physicians, raised $16m in equity funding from luminaries including from Andreessen Horowitz, NEA, Pantera Capital, KB Financial Group, Jerry Yang/AME Cloud Ventures and Dreamers VC. More here ->

Capital on Tap announced Thursday that it has secured a $237 million credit line from $3.8 trillion JPMorgan and investment firm Triple Point. The U.K.-based fintech provides fast funding to small businesses in an all-in-one business credit card and spend management platform. The company was founded in 2012, and more than 200,000 small business customers. More here ->

Complete has raised $4 million in seed funding led by Accel, with support from Y Combinator and executives at Calm, Opendoor and Stripe. The San Francisco startup helps startups think through the “why” and “how” of employee pay. More here ->

NG.CASH, which describes itself as “the financial hub for Brazil’s Generation Z,” closed on a $10 million seed funding round co-led by Andreessen Horowitz (a16z) and monashees. Founded in February of 2021 and launching that August, the startup says it has over 900,000 users. Its founding team is made up of young (under 25) repeat founders who say they are responsible for building one of Brazil’s largest YouTube channels (with over 8 million subscribers), along with another fintech, Trampolin, that was later sold to Stone (Brazil’s version of Stripe). More here ->

Weltio, a Mexico City–based wealth management startup targeting Spanish-speaking LatAm, says it has raised $1.2 million in pre-seed funding from Y Combinator, as well as from Wealthsimple founder Brett Huneycutt, Mercado Bitcoin founder Reinaldo Rabelo, and Rhombuz VC, among others. The company says it provides the ability for Latin Americans to open an account in USD (fully regulated/protected by U.S. relevant bodies) and offers the ability to trade over 10,000 financial products and over 20 crypto coins. More here ->

FOMO Pay, a Singapore-based payments startup, raised $13m in Series A funding. FOMO Pay is the first Major Payment Institution to introduce a cryptocurrency payment method for merchants in Singapore. More here ->

Hello Clever, an Australian "buy to earn" startup, raised A$4.5m in seed funding. Founded in 2021, Hello Clever is a payments and financial management platform aimed at Australia's Gen Z that is billed as as an alternative to debt-based BNPL platforms. At its centre is an API powered by Australia's Payments Platform (NPP) and the associated PayTo and PayID services.The API lets Hello Clever provide real-time cash back for customers when they shop at participating merchants and allows users to track their spending across multiple bank accounts in real-time. The startup uses open banking, fast payments, and AI technologies to help customers find the best merchants for their needs and ensure they get rewards. More here ->

Pezesha, a Kenyan embedded finance startup, raised $11m in equity and debt funding. The fintech’s new growth strategy follows its plan to power its embedded finance offering beyond its current markets, including Uganda and Ghana, to bridge the financing gap affecting millions of micro, small medium-sized enterprises (MSMEs) across these markets. More here ->

Dubai-based Zywa, a neobank for Gen Z, plans to fuel its growth in the United Arab Emirates (UAE), and to kick-start its expansion to Saudi Arabia and Egypt after raising $3 million seed funding at over $30 million (110 million AED) valuation. More here ->

More Fintechs

Savana raises a fresh round of capital to digitize banks’ services — techcrunch.com

Savana, a company providing services to digitize banks' operations, has raised $35 million in a Series A round and $10 million in debt.

Kenyan insurtech Lami raises $3.7M seed extension led by Harlem Capital — techcrunch.com

Lami has expanded to Egypt and Nigeria.

Apple alum’s finance operations startup raises funds to expand globally — techcrunch.com

Unlike a traditional platform that requires specific expertise to operate, Bluecopa's offering is touted to work with no special knowledge requirements.

Apple alum’s finance operations startup raises funds to expand globally — techcrunch.com Unlike a traditional platform that requires specific expertise to operate, Bluecopa's offering is touted to work with no special knowledge requirements.

Argentinian fintech infrastructure startup Geopagos leaves the boot straps behind with $35M funding round Argentinian startup Geopagos serves as a white label infrastructure software provider, aims to give businesses the ability to launch financial services.

Robinhood Veterans’ Fintech Parafin Raises $60 Million in Funding Round — www.bloomberg.com

Parafin, a financial-technology startup run by former Robinhood Markets Inc. staffers, raised $60 million in its second funding round.

FinanZero Raises USD4M in Fourth Funding — www.finsmes.com

FinanZero, a São Paulo, Brazil-based online credit marketplace, raised USD4m in fourth funding

Rapidly scaling PayIt raises another $90M amid ‘long-overdue transformation’ of govtech — www.startlandnews.com Led by the global firm Macquarie Capital Principal Finance, the capital injection is expected to keep fueling PayIt’s commitment to simplify the way people interact with the public sector in everyday places like the DMV and court system.

Crypto

Spectral raises $23M to help create web3 credit scores — techcrunch.com The long-term vision for Spectral, a credit risk assessment infrastructure web3 startup, is to make credit scoring a publicly accessible network.

Mural raised $5.6M to help brands deploy DAO treasuries — techcrunch.com Mural will use new funds to bring on new talent and work with brands globally that want to create and use DAOs

Distributed Finance acquires Algorand NFT marketplace Rand Gallery — www.theblock.co Distributed Finance acquires Algorand NFT marketplace Rand Gallery, and closes a $2.5 million seed round led by Borderless Capital.

Insuretech

Airbnb launches travel insurance — www.insurtechinsights.com In January, Airbnb announced the upcoming launch of a “custom-built” guest travel insurance product offering exclusive to Airbnb...

Cover Genius makes “strategic” hires for business services and property partnerships — www.insurtechinsights.com Cover Genius, an insurtech for embedded insurance, has announced three key additions to its leadership team as demand for embedded...

Urban Jungle expands into motor insurance — www.insurtechinsights.com After strong growth in H2 2021, the number of deals in Europe dropped to 67 in H1 2022 from 74 in the previous six months. The UK was...

FairPlay Launches AI Bias Detection Product for the Insurance Industry — www.insurtechinsights.com FairPlay, the world’s first “Fairness-as-a-Service” solution for algorithmic decision-making, today announced the launch of Input Intellig...

LatAm InsurTech Latú Seguro raises $6.7m - FinTech Global Latú Seguros, a Latin America-based InsurTech, has reportedly raised $6.7m in its pre-seed funding round, led by CRV and Monashees

Proptech

Mudafy raises $10M in Founders Fund-led Series A to fix LatAm’s ‘broken’ real estate process — techcrunch.com Mudafy, which operates in Argentina and Mexico, has raised $10M for its fast-growing digital real estate brokerage.

Real estate tech startup Reali to shut down after raising $100M one year ago — techcrunch.com Proptech startups are struggling. The latest casualty in the space is Reali, which announced it has begun a shutdown and will be laying off most of its workforce

Homeward lays off 20% of workforce — www.realtrends.com Homeward, which offers homebuyers a "Buy Before You Sell" product, laid off 20% of its workforce, citing slowing housing demand.

Redfin and Compass lay off a combined 900+ employees as mortgage interest rates continue to climb — techcrunch.com Real estate tech companies Redfin and Compass both conduct layoffs as the housing market slows.

Citing ‘changing real estate market,’ Utah-based Homie lays off one-third of its staff — techcrunch.com Utah-based proptech Homie has laid off one-third of its staff, according to reports. Hunter Richardson, former director of talent advisory and acquisition at Homie, posted on LinkedIn that he was among the one-third affected but declined to comment on his being let go. Homie was founded in 2015, and according to its CEO and co-founder […]

Kleiner Perkins leads $30M raise for Zumper to meet flexible, short-term rental demand — techcrunch.com Zumper operates an online marketplace to pair landlords with short-term and long-term renters. Kleiner Perkins led its latest raise.

Flyway Raises USD10M in Funding — www.finsmes.com Flyway, a London, UK-and Athens, Greece-based PropTech startup offering fully managed second home co-ownership, raised USD10M in funding

Dubai-based Stake raises $8 million to let people across the globe invest in local properties — techcrunch.com Stake is banking on its team, tech and experience in dealing with different properties to become the most prominent real estate investment platform in MENA

From the Stash

Lemonade, Metromile, EIS – "one of the best insurance deals in 2022" — www.insurtechinsights.com On July 29, the day after the Metromile acquisition closed, Lemonade laid off 20% of the Metromile team, with the explanation...

TD Bank invests in technology, acquisition in Q3 — bankautomationnews.com TD Bank launched new artificial intelligence (AI) capabilities, announced an acquisition and leveraged its Next Evolution of Work (NEW) operating model in its third quarter. The Toronto-based bank increased its technology and equipment spend 12% year over year to $360 million, according to the bank’s Q3 earnings supplement. The increase in tech spend also contributed

CIBC active digital users skyrockets 41% — bankautomationnews.com Canadian Imperial Bank of Commerce (CIBC) will continue investing in technology on the heels of the bank’s active digital users skyrocketing in the third quarter. The $693 billion bank reported its number of active digital banking users in Q3 jumped 41% year over year to 6.2 million users from 4.4 million during the same period

Why insurtech investments are down | Insurtech Insights — www.insurtechinsights.com Insurtech investments fell by 79.6% in 2021, leading to job losses and tough economic conditions for the sector in the first half of 2022...

Rethinking the digital account opening process — bankautomationnews.com Financial institutions can streamline digital account opening (DAO) for their clients by reimagining the process as neobanks do, rather than digitizing their existing processes. For the past 15 years, FIs have been focused on digitizing — rather than rethinking — the customer’s digital journey, Alex Jiminez, managing principal, financial services consulting at EPAM Systems, told

Reports

Embedding finance: Marketplaces with David Barton-Grimley — www.youtube.com According to fintech geeks like us, embedded finance is the next best thing since sliced bread. David Barton-Grimley looks at how embedded finance works, wha...

Button Surpasses $1 Billion in Mobile Commerce as Momentum Builds in 2022 Leading mobile commerce platform Button drove $1 billion in consumer spend in the first half of 2022 on the heels of accelerated growth from new products.

Conferences

Bank Automation Summit — bankautomationsummit.com Bank Automation Summit Fall, taking place September 18-20 at the Hyatt Olive 8 in Seattle, is the premier event to discover tools to enhance your financial institution’s strategy for successful automation and digital advancement.

Announcing the agenda for TechCrunch Disrupt 2022 — techcrunch.com Disrupt is turning 12 years old. If it were a human, it would be addicted to technology (which it is) and starting to get an attitude (again, yes). But after a couple of years coming to you virtually, the world’s most impactful tech startup conference is coming back to real life. The Moscone Center will […]

—

☑️ Thanks for reading. Please ask your friends, colleagues and others to sign up.

If you have any companies or news to share - use the form

AND - if we’re not already connected - let’s do it.