Fintech Highlights - 8/20/2024

Here's what we've been reading and watching this week 👇

Pinned to the Top

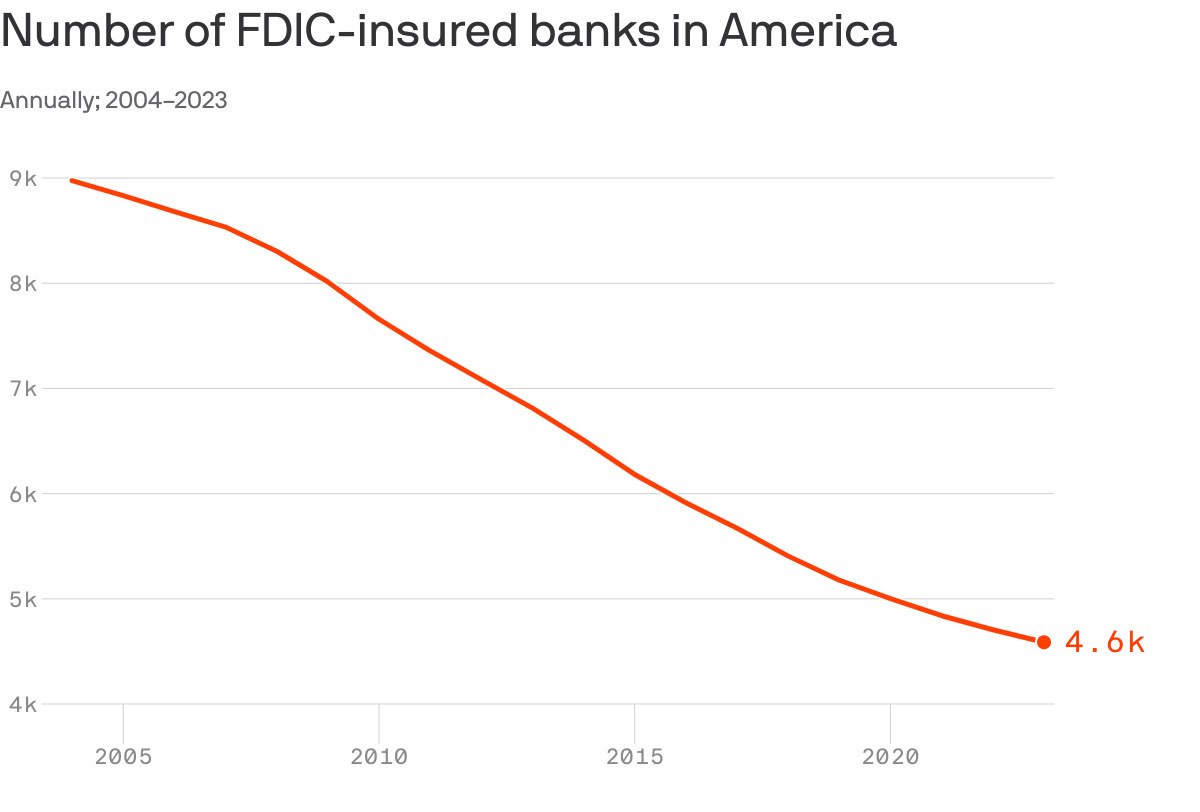

The number of banks in America is on a steady downtrend, in part because they're getting gobbled up by nonprofit credit unions, Axios' Felix Salmon writes.

- Credit unions have many advantages over banks. They pay less in taxes and don't need to deliver profits to shareholders.

- They also have less of a regulatory burden — they aren't subject to Community Reinvestment Act requirements, for instance, and their National Credit Union Share Insurance Fund is in healthier shape than the FDIC's Deposit Insurance Fund.

The bottom line: Until recently, a nonprofit couldn't own a for-profit — it seems to defeat the whole point — but the walls between those worlds are breaking down.

The BFD

Several venture capital funds, including Andreessen Horowitz and Union Square Ventures, have received letters from the SEC over their involvement with decentralized crypto exchange operator Uniswap Labs, per multiple sources.

- Uniswap Labs has raised over $170 million in VC funding, most recently in late 2022 at nearly a $1.7 billion valuation.

- It received, and responded to, a Wells Notice earlier this year. In short, it appears that regulators may accuse Uniswap of being an unregistered exchange.

- A bit of irony is that Uniswap is less vertically integrated than is SEC bete noire Coinbase, in that it's not really the broker. Also worth noting that even if Uniswap Labs was shut down as a company, the actual Uniswap products would keep running.

M&A

Scotiabank (TSX: BNS) agreed to buy a 14.9% stake in Cleveland-based KeyCorp (NYSE: KEY) for around $2.8b. More here ->

Klarna, a Swedish payments firm, is "close to selecting" Goldman Sachs to lead a 2025 IPO that could value the VC-backed company at around $20b, per Bloomberg. More here ->

Experian (LSE: EXPN) acquired NeuroID, a Whitefish, Mont.-based behavioral analytics and fraud prevention startup that had raised $46m from firms like Canapi Ventures, Fin Capital, and TTV Capital. More here ->

Prytek agreed to buy Tipranks, an Israeli stock research platform, for $200m. TipRanks had raised over $100m from firms like Prytek, MORE Investment House, and Poalim Equity. More here ->

AMH (NYSE: AMH) is in advanced talks to buy around 1,700 U.S. rental homes from Man Group (LSE: EMG), per Bloomberg. More here ->

Bridgepoint is weighing a takeover bid for invoicing software provider Esker (Paris: ALESK ), per Bloomberg. More here ->

Howden has completed the acquisition of Health and Life Insurance broker Help Me Compare Group (which trades as ActiveQuote) and its subsidiaries, boosting Howden’s position in the UK market. More here ->

EQT agreed to buy PropertyGuru (NYSE: PGRU), a Southeast Asia-focused property platform, for around $1.1b, or $6.70 per share. More here ->

Sixth Street Partners is leading an acquisition of Credit Suisse's U.S. mortgage servicing business from UBS Group. More here ->

Payoneer is acquiring Singaporean startup Skuad for $61 million in cash, with the potential to pay up to $81 million. This was a pretty fast exit for Skuad founder Sundeep Sahi, who launched the company in 2019 with the aim of simplifying international hiring and had raised $19 million in venture funding. More here ->

Embedded Fintech

Vantage Bank has selected digital banking service provider Unit to improve its core digital banking offerings and provide embedded finance capabilities. Community banks don’t have the resources to execute rapid, high-quality digital transformations which has seen their share of the U.S. banking market decline by 50% over the past 20 years. More here ->

Fintech

Conduit, a B2B cross-border payments startup, raised $6m in seed extension funding . The startup likely provides a platform for businesses to initiate, process, and settle cross-border payments efficiently and securely. More here ->

Amount, a Chicago digital banking firm last valued by VCs at $1b, raised a $30m SAFE note, per Axios Pro. Amount has focused on helping banks finance “buy now, pay later” (BNPL) transactions, either directly to consumers or through retailers. More here ->

Setpoint, an Austin, Texas-based infrastructure provider for the credit industry, raised $31m in Series B funding. The company focuses on infrastructure for capital markets, offering a suite of solutions for borrowers and lenders. More here ->

US fintech Octane raised $50m Series E funding. Octane provides instant financing offers with no impact on credit scores, making it easier for consumers to purchase recreational vehicles, motorcycles, ATVs, and mowers. More here ->

Vayana, an Indian trade credit platform, raised $20.5m in Series D funding. Vayana connects corporates and their trade ecosystems, offering digital, convenient, and affordable access to credit for payables and receivables. More here ->

🚑 PayZen, an SF provider of health care financing tools, raised $32m in Series B funding. It also secured a $200m warehouse credit facility from Viola Credit. More here ->

Skydo, an Indian cross-border payments platform, raised $5m led by Elevation Capital. More here ->

Yuze, a UAE-based provider of business accounts and card programs for SMEs, raised $30m from Osten Investments. More here ->

Investtech

Capitalize, a New York startup focused on automating 401(k) rollovers, raised $19 million in Series B funding, per Axios Pro. Their proprietary technology and expert team handle the entire process, from finding old 401(k)s to managing the rollover, at no cost. More here ->

Syfe, a Singapore-based investment platform, raised $27m in Series C funding. Syfe focuses on risk management, providing customized investment portfolios based on individual risk profiles, rather than solely focusing on returns. More here ->

Crypto

Ion Protocol, a liquidity protocol for staked and restaked assets, raised $4.8m from Gumi Capital Cryptos, Robot Ventures, BanklessVC, NGC Ventures, Finality Capital and SevenX Ventures. More here ->

Insuretech

QuickFacts Raises $2 Million to Accelerate Software Expansion Across North America - QuickFacts, an insurtech startup dedicated to enhancing efficiency in the insurance industry, has announced the successful closure of an oversubscribed $2 million funding round. More here ->

Proptech

EliseAI, a New York developer of chatbots for the housing industry, raised $75m in Series D funding at a valuation north of $1b. More here ->

From the Stash

Barclays, Amazon team up on credit card - London-based Barclays bank and Amazon have come together to launch a co-branded card in the United Kingdom: Amazon Barclaycard. “We’ve launched this card for anyone who loves to shop at Amazon and wants to be rewarded for doing so on their everyday spend,” a Barclays spokesperson told Bank Automation News. More here ->

TD to launch SMB dashboard in October - TD Bank will launch a data-driven small-business insights dashboard in October. Built with insights engine Monit, the dashboard will enable small-business customers to connect their accounting platforms within their banking portal with cash flow forecast insights, Paul Margarites, head of commercial digital platforms at TD Bank, told Bank Automation News. More here ->

PayPal said on August 6 that it is making its quick guest-checkout solution, Fastlane, available to all U.S. merchants - after testing it with select businesses for a few months. Businesses will initially have to use the company’s payment processing services, such as PayPal Braintree or PayPal Complete Payments, to use Fastlane. More here ->

X (formerly Twitter) appears to be making progress on its upcoming payments system - bringing it closer to Elon Musk’s vision of turning X into an “everything app.” According to a recent finding by app researcher Nima Owji, the company is working on adding a “Payments” button to the navigation bar under the bookmarks tab. Owji, who made the discovery, told TechCrunch that he found references for new payment features, such as “transactions, balance, and transfer.” More here ->

Insurity Unveils New Spreadsheet API to Transform Insurance Product Development - Insurity, a leading provider of cloud-based software and analytics for insurance carriers, brokers, and managing general agents (MGAs), has introduced its latest innovation, the Insurity Spreadsheet API. More here ->

Tesla Updates Insurance with State-Specific Discounts Amid Premium Surge, Cybertruck Recall, and Zurich Partnership - Tesla is now providing state-specific discounts for policyholders in the 12 states where Tesla Insurance is available. The discounts are designed to reduce insurance costs by leveraging safety features, multi-car policies, and defensive driving courses. More here ->

PhonePe Launches Pre Approved Term Life Insurance - PhonePe has announced the launch of a 'pre-approved term life insurance' feature on its platform. This new feature is designed to make insurance coverage more accessible and affordable for millions of Indians by waiving the requirement for proof of income at the time of policy purchase. More here ->

Gen AI reduces agent response time by 70% at Discover - Discover Financial Services is tapping generative AI to speed up call center agent response and strengthen client experience. Using Google Cloud’s AI platform, Vertex AI, Discover has reduced response times for call center agents by 70%, Szabolcs Paldy, senior vice president of enterprise operations at Discover, told Bank Automation News. More here ->

Larger FIs may need more time to implement open banking - Open banking regulation is quickly approaching but financial institutions are asking the Consumer Financial Protection Bureau to extend the timeline for implementation. FIs are expected to have an open banking framework in place within six months, according to the CFPB’s proposal. More here ->

—

☑️ Thanks for reading. Please, share this post with your friends, colleagues and tell them to sign up.

If you haven't already signed up - do it now....☝️

If you have any companies or news to share - use the form

AND - if we’re not already connected - let’s do it.