Fintech Highlights - 4/25/2023

April aims to solve taxes. Clerkie raises a round. Web3 funding closes up. Here's what we're watching this week 👇

Pinned to the Top

A young software startup wants to beef up banking apps and services to include yearlong tax awareness

Why it matters: “Tax is a major driver of financial outcomes,” Ben Borodach, CEO and co-founder of April, tells Axios.

- “By opening up access to the tax law, our role is really helping all Americans have the opportunity to maximize [their] financial outcomes.”

The big picture: Unlike many existing tax preparation software systems, April is not a stand-alone service.

- The company integrates its technology into that of banks and other financial platforms such as Acorns and Mercury Financial, with the aim of helping taxpayers get a real-time sense of their tax obligations all year long.

- Come tax time, April can submit filings to the IRS with the right underlying forms based on someone’s answers to personalized questions.

The intrigue: April uses generative AI to translate tax law into software code to assist its tax professionals, a process traditionally performed “purely” by people, Borodach said.

State of play: The company has been supporting 12 institutions since March 1 and has thousands of taxpayers using the service as the tax season continues, Axios was first to report today.

- In the future, more big banks and financial institutions could offer the service directly within their own platforms as a perk or bundled service.

A clever name and strategic idea, April could help financial platforms compete for new customers while increasing their ability to diversify revenue and to strengthen loyalty among existing customers.

M&A

7Ridge acquired American Financial Exchange, an electronic exchange for direct lending and borrowing. More here ->

Fintech

Clerkie, an SF-based provider of debt repayment and optimization tech to lenders, raised $33m in Series A funding. Clerkie is a platform that helps lenders manage and optimize their loan portfolio, reducing time, cost, and headache associated with loan recovery. It also helps users budget, manage money, and pay off credit cards and student loans faster, with "an average lifetime savings of $5,300." More here ->

Rally, a checkout platform for e-commerce merchants, raised $12m in Series A funding. Rally is "a headless checkout that works with any frontend or backend solutions, and will support any apps that build for its ecosystem." They provide one-click checkout with payment processing and tools for post-purchase offer. More here ->

Evergrow, an SF-based fintech focused on clean energy tax credits, raised $7m. Evergrow operates an online market where investors can purchase tax credits from qualifying clean energy projects that can use the newly liquid funds to finance construction. More here ->

Floodlight, a financial platform for e-commerce SMEs, raised $6.4m. The company's platform provides a complete track of the income and expense in one dashboard, tools to improve revenue margins, and customized business insights from a dedicated account manager, enabling entrepreneurs to have financial clarity and grow their businesses. More here ->

Unchained, a provider of financial services for bitcoin holders, raised $60m in Series B funding. Unchained provides expert financial services without the need for worker’s compensation, overtime, paid breaks or lunches, payroll taxes, unemployment insurance or disability. More here ->

Bixby, a provider of credit information on private syndicated loan issuers, raised $5.5m in Series A funding. Bixby’s proprietary software puts the news in the hands of its clients ahead of its competitors, and its standardised approach to data allows clients to look at more opportunities faster. More here ->

CurbWaste, a New York-based provider of payments software to the waste management industry, raised $4m in seed extension funding. It provides features such as real-time dispatch and driver app, order management, and transparency to help companies streamline their operations and save time. More here ->

Super (fka Snapcommerce), an SF-based commerce savings app, raised $60m in equity funding (plus a $25m credit facility). Super is a rewards program that helps users "access more of what they want at better prices, escape overspending, and level up life." More here ->

Yonder, a British credit card rewards startup, raised £12.5m in Series A funding It also secured £50m in debt. Yonder Credit Card is a "modern lifestyle credit card that offers rewards, no foreign exchange fees, and more." More here ->

Triver, a London-based provider of short-term working capital to SMEs, raised £7m. It uses AI to automate invoicing for smaller businesses, helping them secure short-term funds from financial institutions. More here ->

Pagaya (Nasdaq: PGY), an Israeli credit analysis firm, raised $75m. More here ->

Crypto

Fractal, a New York-based digital asset clearing and settlement startup, raised $6m. Fractal offers a cross-collateralized margin account with built-in clearing and reporting.Assets never leave Fractal’s accounts, reducing risk across client funds. More here ->

Insuretech

🚀 Insurance Australia Group (IAG) has invested in US-based Planck, a company that provides AI services to companies working in small business commercial insurance underwriting, through its corporate venture capital arm IAG Firemark Ventures. More here ->

Proptech

Kindred, a home swapping network, raised $15m in Series A funding from NEA, Andreessen Horowitz, Bessemer Venture Partners, Caffeinated Capital and Onset Capital. More here ->

From the Stash

Web3 funding drops hard in Q1 - Web3 funding is down, but so is funding everywhere. Instead of pouring big money into the next exchange or lender, VCs seem to be concentrating on blockchain infrastructure players to help build the foundation for Web3. We take a look at what happened in Q1. More here ->

Top 10 rounds: Clear Street and Astranis raise huge rounds - After several slow weeks, startups saw a nice infusion of cash last week, as seven U.S.-based startups raised nine-figure rounds. Startups in sectors ranging from fintech to fitness and biotech to identity all saw big raises as investor spending picked up in April. More here ->

12 Biggest US Auto Insurers Embracing Tech and Going Digital

The sheer established presence of the USA’s most successful automobile insurance incumbents, is impressive. The market size, measured by revenue is expected to hit US$330.4 billion this year. More here ->

Reports / Webinars

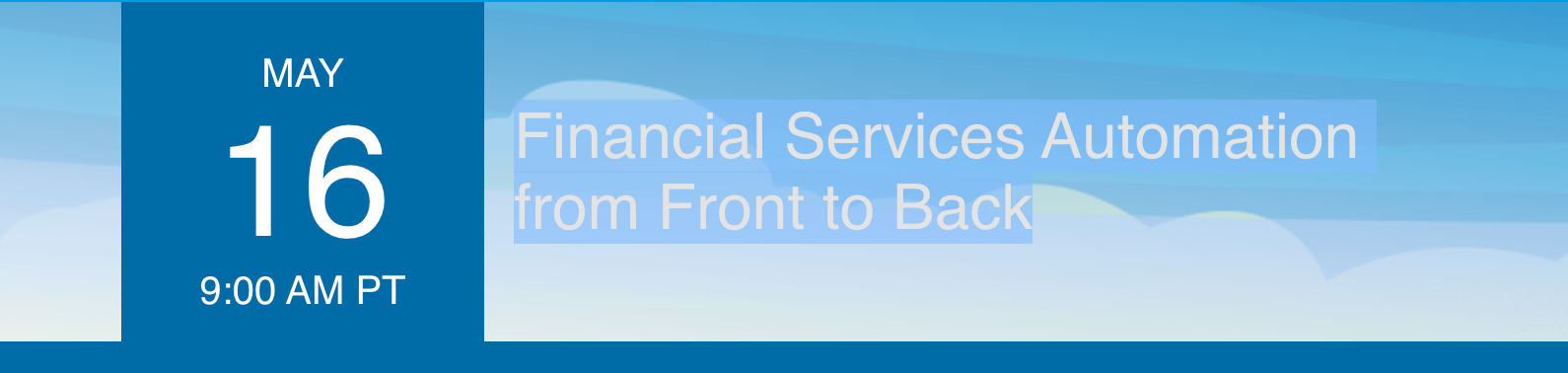

Automation and productivity are top of mind for many financial services institutions (FSIs). Companies are investing in solutions that help reduce costs, increase efficiency, and gain a competitive advantage. But how do you decide where to start, what to automate, and how to maintain controls and compliance?

In this webinar you will :

Learn the guiding principles for automation

Discover best practices to orchestrate work

Uncover new use cases for automation in FSI operations

—

☑️ Thanks for reading. Please ask your friends, colleagues and others to sign up. Use the above.

If you have any companies or news to share - use the form

AND - if we’re not already connected - let’s do it.