Fintech Highlights - 11/22/2022

Pinned to the Top

Klarna is launching a price comparison tool to rival Google and Amazon. Users will be able to compare prices across thousands of retailers as the BNPL giant builds on its acquisition of PriceRunner last year.

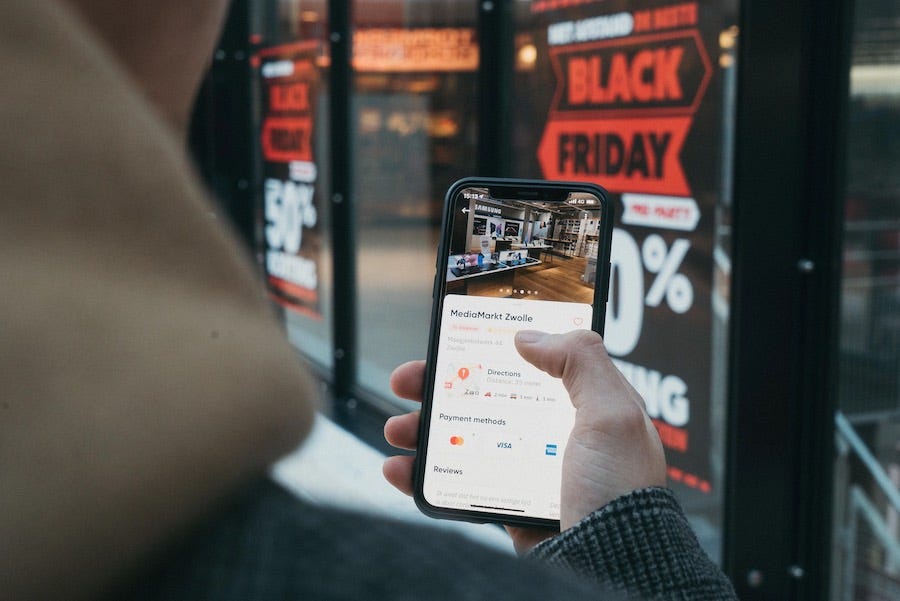

The tool is now available to Klarna App users in the UK, Sweden and Denmark, having launched in the US last month. The timing couldn’t be better with Black Friday just a week away.

It’s been a whirlwind couple of years for Klarna and this move is just the latest twist in the tale. You can choose to interpret it a couple of ways. The cynical view: a company pivoting in a bid to stay afloat in testing times. The more measured view: a natural progression towards building a comprehensive shopping app.

Whether the new feature does provide a “credible alternative” to other giants in the e-commerce space remains to be seen, but the Swedish company clearly sees an opportunity. What’s for certain is that Klarna is moving closer and closer towards an all-in-one shopping experience. At 11:FS, we can’t wait to see what the next move will be.

The BFD

Daylight, a New York-based neobank focused on LGBTQIA+ customers, raised $15 million in Series A funding led by Anthemis Group.

Why it's the BFD: This is the latest in a growing number of digital banking startups aimed at a specific customer demographic or cause, providing niche services that many mainstream banks don't. It also comes the same week as the U.S. Senate pushed forward on a bill that would codify protections for same-sex marriages.

Other investors include CMFG Ventures, Kapor Capital, Citi Ventures and Gaingels.

The bottom line: "Daylight provides debit cards with customers' chosen names, which aren’t always the same as what’s on their ID. It offers members 10% cash back every time they spend with a queer and allied business that Daylight has partnered with. And it offers guided goals for gender-affirming procedures like top surgery and facial feminization." — Kyle Wiggers, TechCrunch

M&A

Atlas Fintech, an Oldsmar, Fla.-based trading tech provider, agreed to go public via Quantum FinTech Acquisition Corp. (NYSE: QFTA), a SPAC that previously terminated an agreement to buy TradeStation Group. More here →

Opn, a Japanese digital payments processor valued by VCs at $1b, acquired Alpharetta, Ga.-based payments platform MerchantE from Integrum Holdings for about $400m. More here →

Skyward Specialty Insurance Group, a Houston-based specialty property & casualty insurer focused on underserved markets, filed for a $100m IPO. It plans to list on the Nasdaq (SKWD) and is backed by Westaim Corp. More here →

Embedded Fintech

If the banking-as-a-service fintech Unit does its job right, it will be ubiquitous among businesses and simultaneously have a name unknown to the end user. The company gives companies a way to embed financial services into their product — and after already launching debit cards, Unit is officially breaking into the charge card game. More here →

Fintech

Banked, a London-based real-time payments network, raised $15m in new Series A funding. Banked now has close to 100 staff and is expanding rapidly. More here →

Linktree, the “link in bio” startup (which has some 30 million users and drives around 1.5 billion monthly unique visits to linked content), has launched “Payment Lock.” The beta feature will let creators build payments links — locks — around content and other items that otherwise might not cost anything to use, or might not even be chargeable on the originating platform, but might represent something valuable to a creators’ fans and followers. More here →

Service 1st Financial, a Bethesda, Md.-based fintech for home contractors, raised $20m in Series B equity and debt funding. With heating, cooling, and plumbing system replacements continually rising in cost, Service 1st's Premier Program® offers homeowners a worry-free service to replace and upgrade their home comfort systems. For a predictable, low monthly payment, homeowners receive the latest energy-efficient equipment, while eliminating the common pain points associated with owning, maintaining, and repairing such systems. More here →

Zulu, a Colombia-based digital wallet, raised $5m in seed funding. Its platform enables Android and iOS users to save in secure digital dollars and send cross-border payments at no cost. In addition, it protects users from the currency devaluations that often occur in countries like Colombia, Venezuela and Peru More here →

Beam, a Thai one-click payment startup, raised $2.5m in seed funding. Beam says its checkout process takes just 20 seconds. It accepts all major payment service providers in each market, like BNPL leaders Atome and Pace, and claims sellers using their payment solution have increased checkout success by up to 30%. More here →

Investtech

Baraka, a Dubai-based commission-free investment platform, raised $20m in Series A funding. Since baraka is a zero-commission platform, it doesn’t make revenue off commissions, trades or spreads. Instead, it’s from a subscription service, about $10 (~37.99 dirhams) per month, that retail investors can use to access more financial data about companies and stock reports from baraka’s partner Refinitiv. More here →

The Trading Pit, a Liechtenstein-based trading and asset management firm, raised €10m. The Trading Pit is a trading fintech company set to enable global access to all major asset classes, including Forex, Futures, Stocks and Cryptos, within the next 6 months. More here →

Fennel, an ESG investing and shareholder engagement app, raised $5m from individual investors, per Axios Pro. More here →

Crypto / Web 3

⚡ Anode Labs, an Austin, Texas-based web3 platform for tokenizing energy storage assets, raised $4.2m. The company’s React Network is aiming to modernize the national power grid by creating a community owned network connecting energy storage assets to markets that value them. More here →

Insuretech

Nationwide announced a partnership with Human API to improve the life insurance buying experience by maximizing the use of digital health data to accelerate the underwriting process. More here →

“Digital insurance agency” Glow has raised $22.5M in Series A funding. Glow is an Insurtech that aims to automate the insurance process for SMEs. The funding will be used to expand its services across more states and build out its platform. More here →

Betterview, an Insurtech provider of actionable property intelligence to property/casualty insurers, and core insurance system/platform provider Guidewire Software, have announced the launch of Betterview’s new Hail Risk Insights, created in collaboration with Guidewire. More here →

Proptech

Valcre, a San Diego-based commercial real estate appraisal platform, raised $12.7m in Series A funding. Valcre is “the commercial real estate industry’s premier end-to-end appraisal software solution, empowering users with a more organized, efficient and intelligent path to produce and present their work.” More here →

Atmos, an SF-based online marketplace for custom home design and development, raised $12.5m in Series A funding. Founded in 2018, San Francisco-based Atmos touts that with its tech, homebuyers are able to select land, design a home within their budget and approve the design using 3D tech. It then teams up buyers with a “vetted builder partner.” More here →

Silkhaus, a Dubai-based short-term property rental platform, raised $7.75m. Essentially, Silkhaus takes rental units from asset owners (in Dubai, at the moment) and manages distribution, pricing, revenue management and full coverage from a digital perspective; Airbnb is one of approximately 60 different distribution channels Silkhaus uses. Meanwhile, the company has built tools on the back end, including a marketplace for third-party vendors to access these rentals and handle operations. More here →

From the Stash

Huntington digital checking acquisitions up over 200%. The $179 billion Huntington’s digital checking acquisition increased to 46% this year, up 228% from 14% in 2017, according to the bank’s 2022 Investor Day presentation. More here →

FTX collapse will reverberate through VC world for a long time. The collapse of FTX was swift, but its effects will be continuous and long-lasting. Some of the biggest names in VC and investing put money into the crypto giant, and FTX in turn invested in other startups through its trading firms. More here →

Just like FTX, FTX Ventures invested big and fast. FTX Ventures was primed to be a major player in the venture world this year with almost 50 different investments that raised nearly $3 billion for burgeoning startups. We look at the big numbers this young firm racked up before FTX’s collapse. More here →

Genesis halts withdrawals as FTX-induced ‘crypto contagion’ spreads. Crypto has gone from a winter to a contagion. Crypto lender Genesis said Wednesday it is suspending withdrawals and new loans after the dramatic collapse of crypto exchange FTX. More here →

Fiat Ventures, with $25M for first fund, brings ‘insider’ approach to investing in early-stage fintechs. The early-stage VC firm started in 2021 is now armed with $25 million in capital commitments to close its first fund; the partners are targeting financial services and financial technology startups building for the 90% of Americans who don’t already have enough savings or don’t know how to start managing what they do have. More here →

Mastercard Engage adds fintech Amount to partner network. Digital banking fintech Amount is now offering financial services solutions through the Mastercard Engage global partner network as the credit card giant enters the open banking space. More here →

Reports / Webinars / Conferences

Salesforce - Better experiences start with automation

Surveying 2250 FS customers and interviewing 6 industry experts, we found companies that invest in their customer experience outperform those that don’t by 70%.

Explore what your customers are looking for, where the industry is meeting their needs, and where it’s falling short in our latest report.

—

☑️ Thanks for reading. Please ask your friends, colleagues and others to sign up.

If you have any companies or news to share - use the form

AND - if we’re not already connected - let’s do it.

Thanks for reading tuuk! Subscribe for free to receive new posts and support my work.