Fintech Highlights - 2/22/2024

This one is a DOOOZY…..

Regulatory challenges of the Cap One / Discover offer. Bitcoin is rising. Issues at New York Community Bancorp.

Here's what we've been watching this week 👇

Pinned to the Top

Let's unpack the big news from Tuesday...

Capital One's $35 billion deal to buy Discover would make McLean, Va.-based Capital One the largest credit card issuer in America, Axios' Felix Salmon writes.

- JPMorgan Chase currently leads the ranking, with a 16% market share. The combined company would have 19%.

Why it matters: Some 4,000 banks offer credit cards. But the top 10 issuers, including both Discover and Capital One, account for 80%+ of loans.

- That concentration seems to have given the biggest lenders the ability to charge higher interest rates on outstanding balances. (Explore the numbers.)

The big picture: It's this year's biggest merger globally, surpassing Synopsys' $34 billion acquisition of software developer Ansys in January. (Bloomberg)

What we're watching: It's unclear whether the deal will pass regulatory scrutiny. (See below for more on that part 😉)

The BFD

Antitrust watch: If the Department of Justice decides to challenge the acquisition of Discover by Capital One on antitrust grounds, new research from the Consumer Financial Protection Bureau will surely play a prominent role in the complaint, reports Axios' Felix Salmon.

- Even though some 4,000 banks offer credit cards, the top 10 issuers, including both Discover and Capital One, account for more than 80% of loans.

- That concentration seems to have given the biggest lenders the ability to jack up the interest rates they charge on outstanding credit card balances.

The bottom line: "Both companies are known for their larger portfolio of low and subprime customers compared to their competitors. Discover has been particularly under pressure, with the company saying it expects to spend $500 million or more on compliance and risk this year."

Another BFD

Bitcoin broke $50,000 last week - for the first time since December 2021.

Why it matters: It's a sign that there really was consumer demand for a way to invest in cryptocurrency using a familiar investment vehicle like an exchange-traded fund.

💰 The SEC ran out of ways to keep bitcoin ETFs off the public market. So it reluctantly gave the green light to a set of offerings in January while making clear its reservations.

When customers buy bitcoin ETFs, issuers must purchase actual bitcoin from the open market to back those instruments.

The Final BFD

New York Community Bancorp once looked like a winner of last spring's regional banking crisis. Now it's in trouble.

- The company's shares have lost more than 60% of their value since Jan. 31, when it announced a major Q4 loss.

The big question: Could there be contagion that sparks another investment and acquisition surge, much like when Silicon Valley Bank's collapse begat transactions for rivals like First Republic and PacWest?

The big answer: It shouldn't, based on the underlying fundamentals.

- NYCB's big problem is an overconcentration of commercial and multi-family real estate loans, at a time when many New Yorkers are still working from home and state lawmakers have limited residential rent increases.

- Matthew Breese, a banking analyst with Stephens, said yesterday that NYCB had more than twice the exposure (as a percentage of assets) of the next highest peer bank.

- Plus, there hasn't yet been a run on NYCB's deposits, most of which go under the Flagstar business it acquired at the end of 2022. That's a stark contrast to what happened at SVB.

Caveat: Banking crises are crises of confidence, not sober analyses of underlying fundamentals. If NYCB were to fail, the shrapnel could fly in very unexpected directions.

Backstory: NYCB was a buyer during last year's banking crisis, acquiring most of the non-crypto assets of Signature Bank.

- That deal, plus the Flagstar purchase, pushed NYCB past the $100 billion asset threshold that put it in a new regulatory oversight category.

Zoom out: The OCC last month proposed new regulations around bank M&A.

The bottom line: NYCB is in full damage control mode, reshuffling top management and reportedly trying to offload mortgage risk. We'll soon know if it's too little too late and, if so, if the damage can be contained.

M&A

Ripple agreed to acquire Standard Custody & Trust Co., a crypto custodian that last raised $53m in Series C funding from investors like Cowen Digital, Brevan Howard and GSR. More here ->

Global Payments (NYSE: GPN) is in advanced talks to buy Takepayments, a British provider of retail payment processing solutions, for more than $250m, per Reuters. More here ->

Nordic Capital agreed to buy a majority stake in Zafin, a Canadian provider of SaaS core modernization solutions for financial institutions that had raised funding from Kayne Anderson and Vistara Growth. More here ->

HiBob, a New York-based HR and benefits company valued by VCs at $2.4b, agreed to acquire Pento, a British payrolls startup, for around $40m in cash and stock. Pento had raised over $50m from firms like Tiger Global, Seedcamp, General Catalyst, Hustle Fund, Moonfire, Point Nine Capital, and Avid Ventures. More here ->

FairMoney is reportedly in discussions to acquire Umba, a Nigeria and Kenya-based credit-led digital bank, for $20m in all-stock deal, per TechCrunch. More here ->

Truist nears sale of insurance arm to Stone Point, CD&R - Truist Financial Corp. is nearing a deal to sell a majority stake in its insurance brokerage business to Stone Point Capital and Clayton Dubilier & Rice, people familiar with the matter said. The sale of the stake in Truist Insurance Holdings could be announced as soon as this week More here ->

Embedded Platforms

Fintech

Parlay, an Alexandria, Va.-based small-business loan platform, raised $1.3m in pre-seed funding. It is an embedded fintech software that helps community banks and credit unions get more small businesses approved for loans. More here ->

Insuretech

Insurtech startup Buddy has raised US$7 million from 49 investors, bringing its funding total to $8 million. It serves as an insurance gateway for software companies. It enables the embedding of insurance products into transaction flows, simplifying the process for software applications. More here ->

Fintech

Ribbon, a SaaS startup that helps banks automate inheritance claims, raised $2.7 million in pre-seed funding. The company has created a software platform that gives individuals and businesses the banking, accounting, fundraising, and organizational tools they need to build a successful charity under the umbrella of a fiscal sponsor. More here ->

PatientFi, an Irvine, Calif.-based financing platform to help patients pay for out-of-pocket elective procedures, netted $25 million. The company provides a platform that offers patient financing solutions, aiming to simplify the financial experience for patients and reduce risk and expense for healthcare providers. More here ->

Anatomy Financial, an SF-based automated billing platform for health care practices, raised $7.6m. The company offers a suite of solutions that facilitate the billing process for healthcare organizations by converting Explanation of Benefits (EOB) documents to Electronic Remittance Advice (ERA) and automating financial reconciliation. More here ->

Cascading AI, an SF-based loan origination platform, raised $3.9m in pre-seed funding. Casca, the flagship product of Cascading AI, is designed to revolutionize the lending landscape by automating time-consuming tasks in loan origination, reducing the loan cycle time, and increasing efficiency. More here ->

Duetti, a New York-based music financing platform led by former Tidal and Apple Music execs, raised $15m in equity led by Nyca Partners and a $75m credit facility. More here ->

More fintech:

Investtech

Rogo, a New York-based generative AI startup for financial services, raised $7m. The platform is designed to save time, unlock insights, and automate workflows for elite financial institutions, including investment banks, hedge funds, asset management firms, and private equity investors. More here ->

Exponential Markets, a New York-based financial risk mitigation startup, raised $10.3m in seed funding. It focuses on creating market-based solutions for new asset classes. . More here ->

FlowFi, an LA-based financial advisor marketplace for entrepreneurs, raised $9m in seed funding. More here ->

Sibli, a Canadian based investment research startup, raised $4.5m in seed funding. The company, founded by a team of AI and finance experts, uses generative AI and large language models to process unstructured data and provide relevant insights to asset managers, aiming to help them gain an information advantage over their peers. More here ->

Architect Financial Technologies, a multi-asset brokerage for sophisticated traders, raised $12m in seed funding. The startup was founded by Brett Harrison, former president of FTX.us. More here ->

Crypto

Superform Labs, a crypto yield marketplace, raised $6.5m in seed funding. It is designed to be a chain-agnostic distribution layer for yield, enabling the composition of yield from any chain using any asset. More here ->

Proptech

Higharc, a Durham, N.C.-based cloud platform for homebuilding operations, raised $53m in Series B funding. The platform helps homebuilders transform how they sell and build new homes and communities, with the aim of improving operational efficiency and customer experiences. More here ->

Bob W, a Finnish marketplace for short-term apartment rentals, raised €40m in Series B funding. More here ->

From the Stash

FedNow, RTP adoption neck and neck - The Federal Reserve’s FedNow payments network, launched nearly seven months ago, has signed up almost as many financial institutions as The Clearing House’s Real Time Payments platform has in seven years. “This is the first time that there’s actually been an upgrade in the plumbing [of the financial network] in nearly 50 years,” More here ->

JPM builds its own omnichannel payments offering - J.P. Morgan Payments introduced its omnichannel checkout solution in January to offer a retail shopping experience that is native across shopping channels. “Merchants need to provide journeys that natively go across channels,” Jean-Marc Thienpont, managing director of omnichannel and biometric solutions at J.P. Morgan Payments, told Bank Automation News. More here ->

Zurich Insurance Group’s Bid for 70% Stake in Kotak’s Insurance Arm Gets Green Light - Zurich Insurance Group, a prominent Switzerland-based insurer, has received approval from Indian competition regulators for its acquisition of a 70% stake in Kotak Mahindra General Insurance Company (KMGIC). More here ->

HDI Embedded Partners with Wind Tre and wefox - The embedded insurance provider, part of HDI International, will enable greater coverage and extended warranty solutions for customers of Italian mobile operator Wind Tre. More here ->

Capital One, Discover integration could cost $2.8B - Capital One announced its plans to acquire Riverwoods, Ill.-based Discover Financial Services and expects to spend $2.8 billion on integration costs, including tech conversion. “Capital One certainly has some good experience in the space. … They have done a number of tuck-ins and so I imagine they have [an acquisition] playbook,” More here ->

A new dating app was released just in time for Valentine’s Day, but there’s a catch - You must have at least a 675 credit score to use it. Launched by financial platform Neon Money Club, Score is a dating app for people with good to excellent credit, and it seeks to help raise awareness about the importance of finances in relationships. More here ->

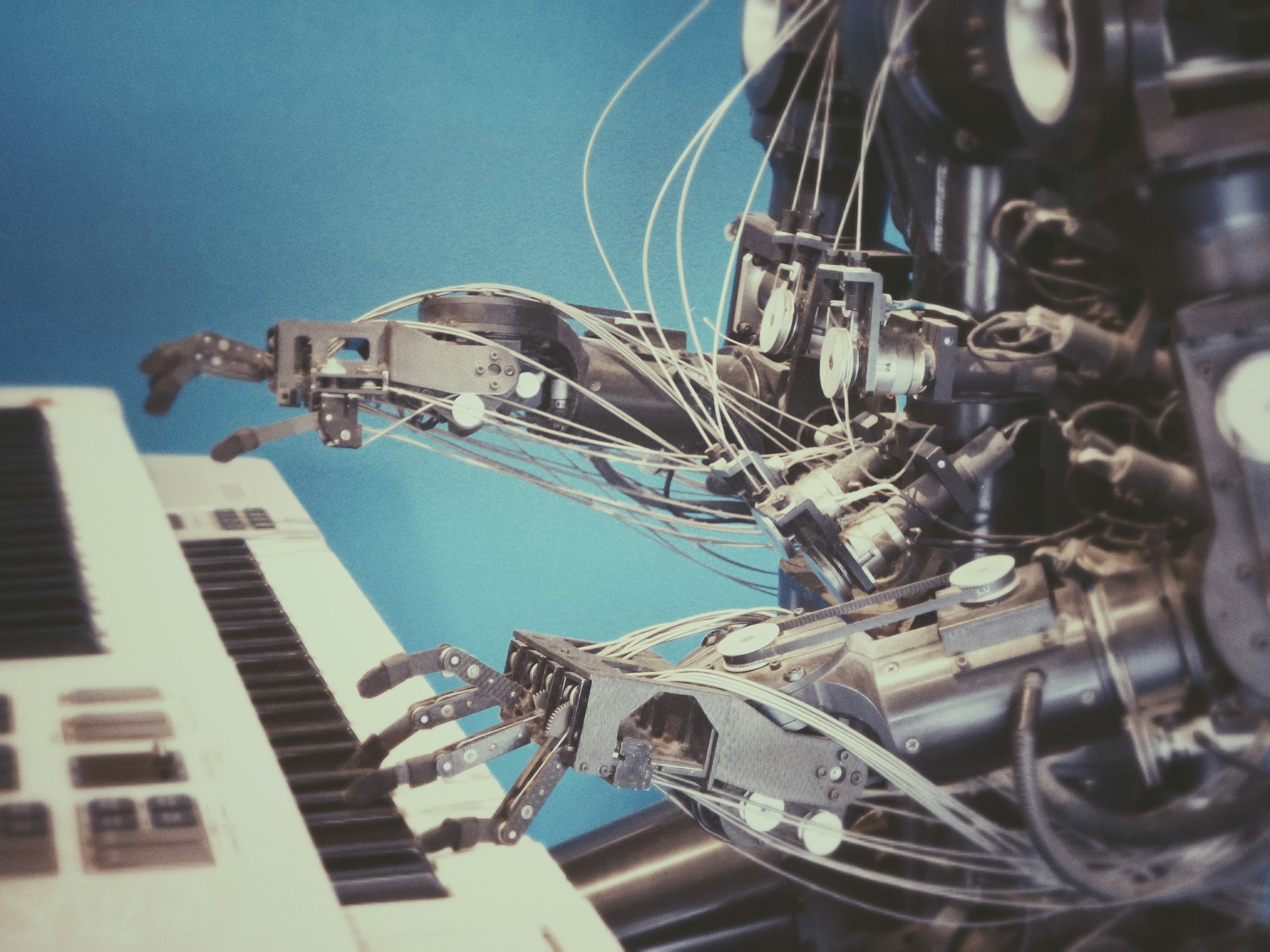

Reports / Webinars

What bank execs are saying about gen AI - Banks are identifying uses for generative AI and finding ways to make it effective and responsible. According to a Dec. 11 report by consulting giant EY, 100% of respondents said they are either already using or plan to use generative AI within their institutions. The report surveyed 300 executive directors, managing directors or higher.

—

☑️ Thanks for reading. Please, share this post with your friends, colleagues and tell them to sign up.

If you haven't already signed up - do it now....☝️

If you have any companies or news to share - use the form

AND - if we’re not already connected - let’s do it.

.